Battery stocks have dominated headlines as investors look for the next big breakthrough in range and charging speed. Solid-state batteries are at the center of that excitement, promising faster charging, higher energy density, and safer performance than today’s lithium-ion technology.

QuantumScape (QS) is one of the leading hopefuls in this race. And now it has drawn fresh attention after Ray Dalio’s Bridgewater Associates quietly bought a small stake, about 266,000 shares worth roughly $3.3 million, during Q3 2025. The purchase immediately raised questions: Is this a sign of growing institutional confidence or simply a tiny speculative move from the world’s largest hedge fund?

For investors watching the solid-state battery story unfold, here’s what Bridgewater’s move might mean.

About QuantumScape Stock

QuantumScape is a solid-state battery startup trying to revolutionize EV energy storage. Its goal is to make lithium-metal batteries that charge ultra-fast and hold more energy (imagine a Tesla (TSLA) battery doubling its range). The company has no real revenue yet as it’s still in development, but it has top investors like Volkswagen (VWAGY) and PowerCo and strategic partners to bankroll the R&D.

With a modest $9 billion market cap, QS has had a huge year. The stock more than doubled, jumping from around $5 to the mid-teens before settling near $11.50. That surge came from upbeat partnership announcements, fresh tech milestones, and growing excitement about solid-state battery potential.

Following the rally, conventional valuation metrics look rich. For example, QS trades at roughly 6.6x book value, far above the 1.6x industry median. In plain language, investors are paying more than six times what the company is worth on its balance sheet, more than triple what peers pay.

Bridgewater’s Move: What Happened

Bridgewater recently stepped in and revealed a small but noticeable increase in its QS position. The firm first bought a tiny slice of QS in early 2022, and the meaningful move came in Q3 2025. Bridgewater ended the quarter with about 266,200 shares, roughly a $3.28 million stake, after holding almost nothing before. Even so, QS still represents only about 0.01% of Bridgewater’s portfolio, making it a relatively small bet for the fund.

The addition signals some confidence, but it’s just one data point. Bridgewater has followed QS for years and simply decided to add a bit more recently. There was no big public endorsement, and the market hardly reacted since QS was already climbing.

In reality, Bridgewater’s move mostly adds a bit of buzz and might prompt other investors to take another look, but it won’t shift QS’s fundamentals overnight.

QuantumScape Is Burning Cash Yet Has Strong Liquidity

QuantumScape’s latest financials show a company that’s still firmly in development mode but finally starting to see early signs of commercial traction. The company reported no product revenue in Q3, which is expected for a pre-commercial battery startup, but it did generate $12.8 million in customer “billings.” These billings are essentially invoices tied to joint development work with partners like Volkswagen, not true sales yet, but a meaningful step forward from zero a year ago.

On the expense side, QS continues to burn cash as it invests heavily in R&D and manufacturing scale-up. It posted a GAAP net loss of $105.8 million, with operating cash outflow of about $63.7 million and another $9.6 million going toward capex.

The good news is that the company’s balance sheet remains strong. QuantumScape ended the quarter with roughly $1 billion in liquidity, including cash, equivalents, and marketable securities, thanks in part to a $263 million equity raise earlier this year that extended its runway into 2029.

Management also tightened full-year loss guidance, suggesting some cost discipline even as development ramps.

What Do Analysts Say About QS Stock?

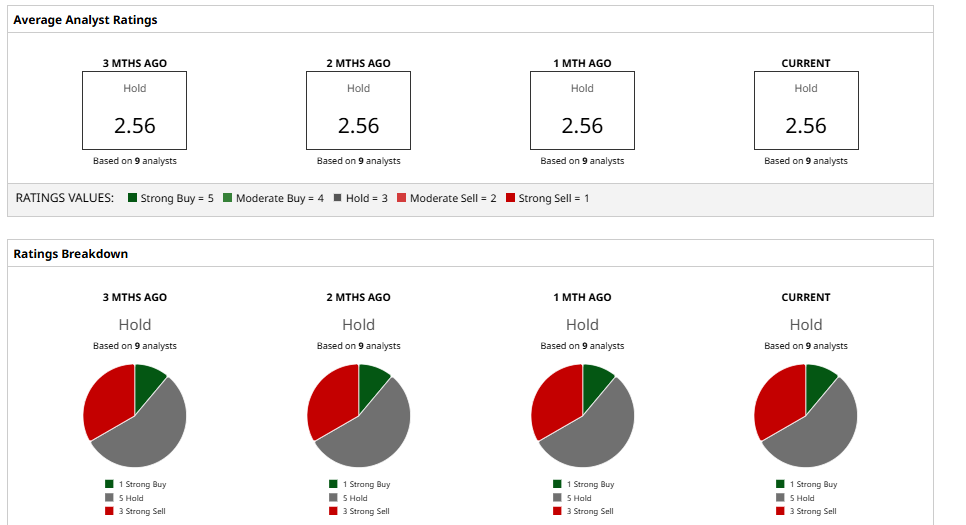

Wall Street remains divided on QuantumScape, and most analysts are still cautious. Several firms have raised their price targets but aren’t ready to call QS a “Buy,” quite yet. HSBC lifted its target to $10.5 but cut the stock to “Sell,” citing high risk despite the higher valuation estimate. TD Cowen boosted its target to $16 while keeping a “Hold,” and Baird maintained a “Neutral” view with an $11 target.

On the bearish end, Goldman Sachs continues to be one of QS’s toughest critics, sticking to a $2.50 target and a “Strong Sell.” Overall, the consensus lands around $9 per share, which is significantly above its current price of $11, with a broader “Sell” outlook.

Analysts also don’t expect meaningful GAAP revenue from QuantumScape anytime soon. Barchart data point to a full-year EPS of about -$0.74 for 2025 and -$0.64 for 2026, with revenue estimates near zero in 2025 and only around $4 million in 2026. That small bump simply reflects early licensing and development fees, not commercial product sales, reinforcing the view that QS remains a long-term, high-risk story.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Down 11% Last Week, Should You Buy the Robinhood (HOOD) Discount? Here’s What You Need to Know

- 3 Under-the-Radar Tech Stocks to Buy as Nvidia Proves the AI Trade Has Staying Power

- Bridgewater Associates Just Bought QuantumScape Stock. Should You?

- Palo Alto Networks' Stock Has Tanked But Its FCF is Strong - Price Target is 15% Higher