With a market cap of $150.6 billion, Lowe's Companies, Inc. (LOW) is a U.S.-based home improvement retailer offering a wide range of products for construction, maintenance, repair, remodeling, and home décor through its stores, website, and mobile apps. It serves both professional customers and homeowners with brand-name and private-label products, along with installation and repair services.

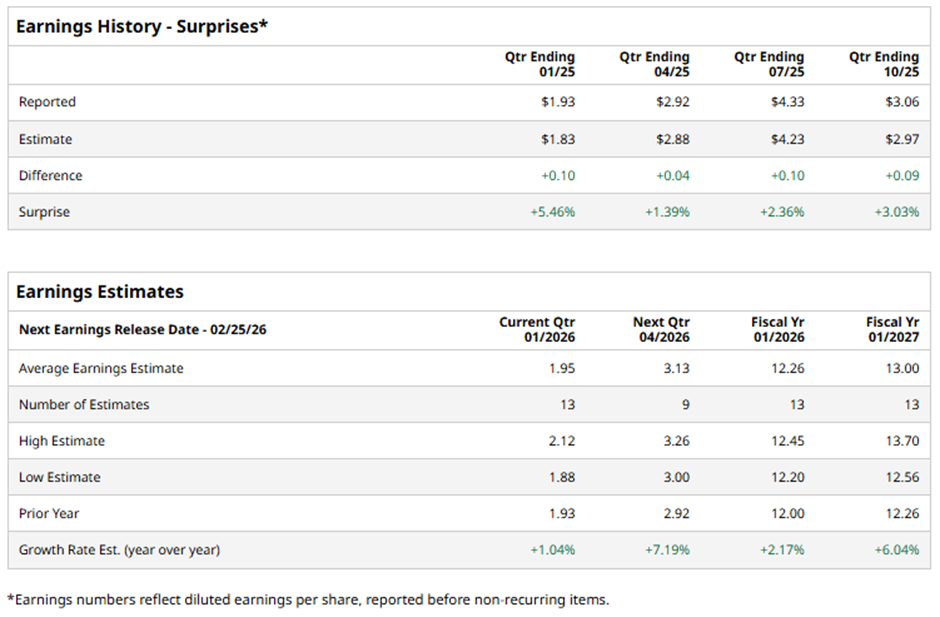

The Mooresville, North Carolina-based company is expected to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts expect LOW to report an adjusted EPS of $1.95, up over 1% from $1.93 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the home improvement retailer to report an adjusted EPS of $12.26, a 2.2% rise from $12 in fiscal 2024. In addition, adjusted EPS is anticipated to grow over 6% year-over-year to $13 in fiscal 2026.

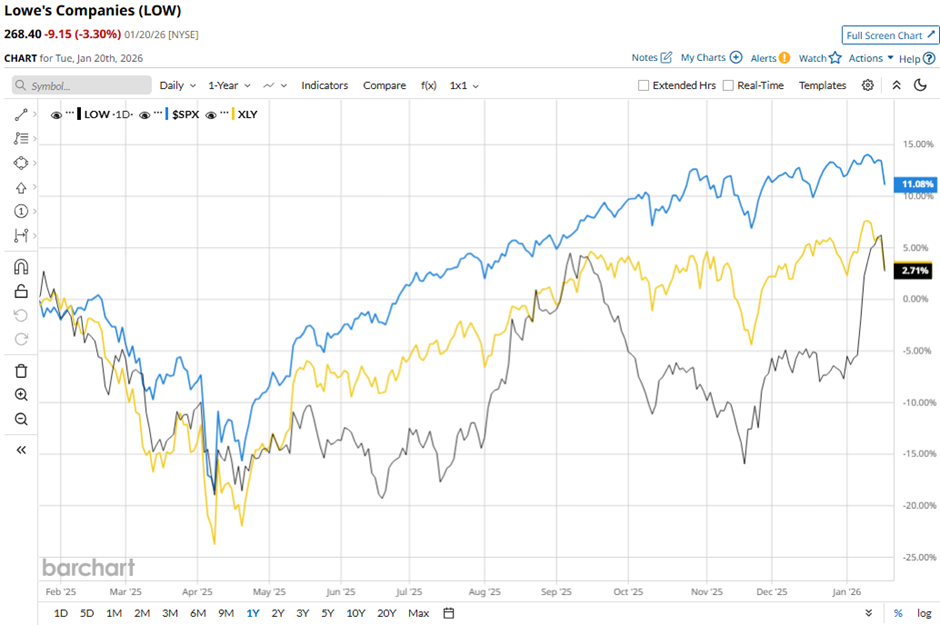

Lowe's shares have gained 2.8% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 13.3% rise and the State Street Consumer Discretionary Select Sector SPDR ETF's (XLY) 3.9% return over the period.

Shares of Lowe’s rose over 4% on Nov. 19 after the company reported stronger-than-expected Q3 2025 results, including total sales of $20.8 billion and adjusted EPS of $3.06. Investors also reacted positively to Lowe’s updated full-year 2025 outlook, raising projected total sales to $86 billion and maintaining an adjusted EPS target of approximately $12.25. In addition, strong 11.4% online sales growth, double-digit growth in home services, and continued expansion in Pro sales boosted confidence.

Analysts' consensus view on LOW stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 29 analysts covering the stock, 19 recommend "Strong Buy," one suggests "Moderate Buy," eight indicates “Hold,” and one gives "Strong Sell." The average analyst price target for Lowe's is $281.79, suggesting a potential upside of nearly 5% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart