High-growth stocks in a portfolio provide the adrenaline rush and serve the objective of maximizing returns. However, it’s low-beta dividend stocks that provide stability coupled with steady returns. As a top-rated dividend king to buy for 2026, Walmart (WMT) stock is attractive for the medium to long term.

Dividend Kings are companies that have consecutively increased their dividend payout to shareholders for at least 50 consecutive years. It goes without saying that this is an elite list of companies with strong fundamentals.

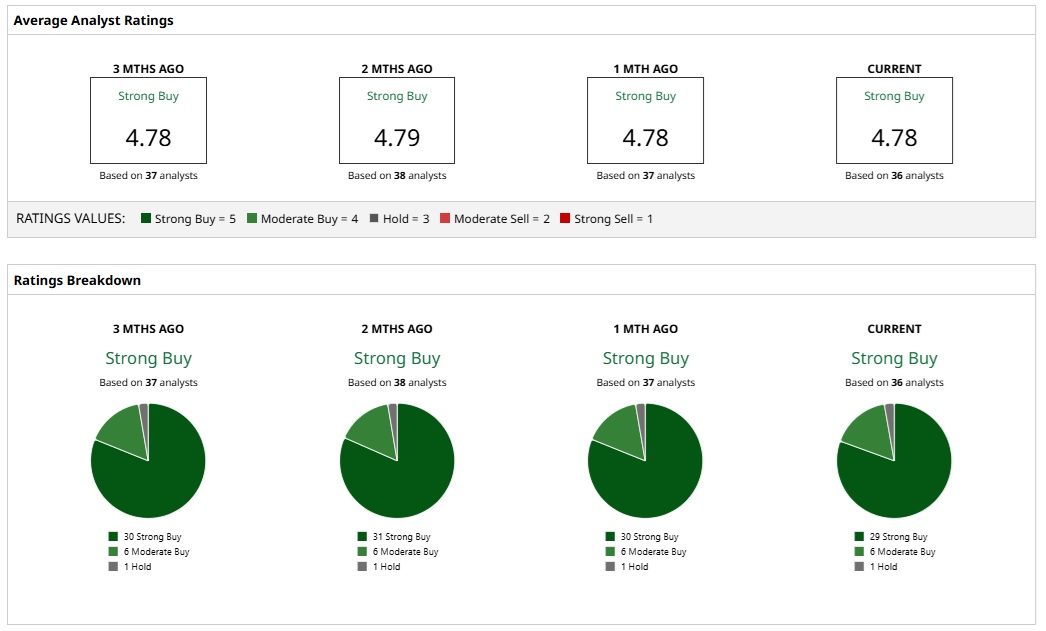

Within this space of Dividend Kings, my top-rated stock for 2026 is screened on the basis of the highest analyst rating, which is a good indicator of the bullish sentiment.

About Walmart Stock

Headquartered in Bentonville, Walmart is the operator of retail and wholesale stores. The company operates through segments that include Walmart U.S., Walmart International, and Sam’s Club.

Besides having more than 10,750 stores, Walmart has also focused on building its e-commerce presence. As an omnichannel retailer, the company clocked revenue of $681 billion for FY25.

Backed by strong results and healthy growth guidance, WMT stock has trended higher by 25% in the past 52 weeks. Further, Walmart offers an annualized dividend of 94 cents, and it’s likely that dividends will continue to swell on the back of strong earnings.

Strong Q3 Results and Optimistic Guidance

For Q3 2025, Walmart reported healthy year-on-year (YoY) revenue growth of 5.8% to $179.5 billion. A key highlight of the results was a 27% growth in global e-commerce sales. As Walmart builds a stronger omnichannel network, there is ample headroom for growth in international markets.

Another important point to note is that Walmart U.S. reported sales growth of 5.1%. However, Walmart International delivered robust sales growth of 10.8%. This was driven by Flipkart in India, Walmex in Mexico, and expansion in China. This underscores the view that sales outside the U.S. can be a key growth driver.

From a fundamental perspective, Walmart ended Q3 with a cash buffer of $10.6 billion. Additionally, operating cash flow for the first nine months of FY25 was $27.5 billion. While Walmart has a total debt of $53.1 billion, credit metrics are likely to remain strong. At the same time, healthy free cash flows are likely to ensure sustained shareholder value creation.

Besides these positives, the guidance for FY26 has been revised higher. Walmart now expects top-line growth in the range of 4.8% to 5.1%. Adjusted operating income margin is also expected in the range of 4.8% to 5.5%.

Moody’s economist Mark Zandi recently opined that the Fed is likely to surprise with three rate cuts in the first half of 2026. If this holds true, expansionary policies are likely to boost consumption spending. This will have a positive impact on Walmart going into FY27. At the same time, international markets remain a key growth trigger.

What Analysts Say About WMT Stock

Based on the ratings of 36 analysts, WMT stock is a consensus “Strong Buy.” While 29 analysts assign a “Strong Buy” rating to WMT, six analysts have a “Moderate Buy” rating, and one analyst has a “Hold” rating.

Based on these ratings, analysts have a mean price target of $122.91 currently, which would imply an upside potential of 7.5%. Further, with the most bullish price target of $160, the upside potential for WMT stock is 18.9%.

It’s worth noting that WMT stock valuation might seem stretched considering a forward price-earnings ratio of 42.3. However, the business commands a valuation premium based on the factors of steady growth, strong cash flows, and a low beta. Further, Costco Wholesale (COST), which is a close peer, also commands similar valuations with a forward price-earnings ratio of 42.9.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart