With a market cap of $194.8 billion, QUALCOMM Incorporated (QCOM) is a global technology company that develops and commercializes foundational wireless technologies through its semiconductor, licensing, and strategic investment businesses. It serves markets including mobile devices, automotive, IoT, 5G, artificial intelligence, and government solutions.

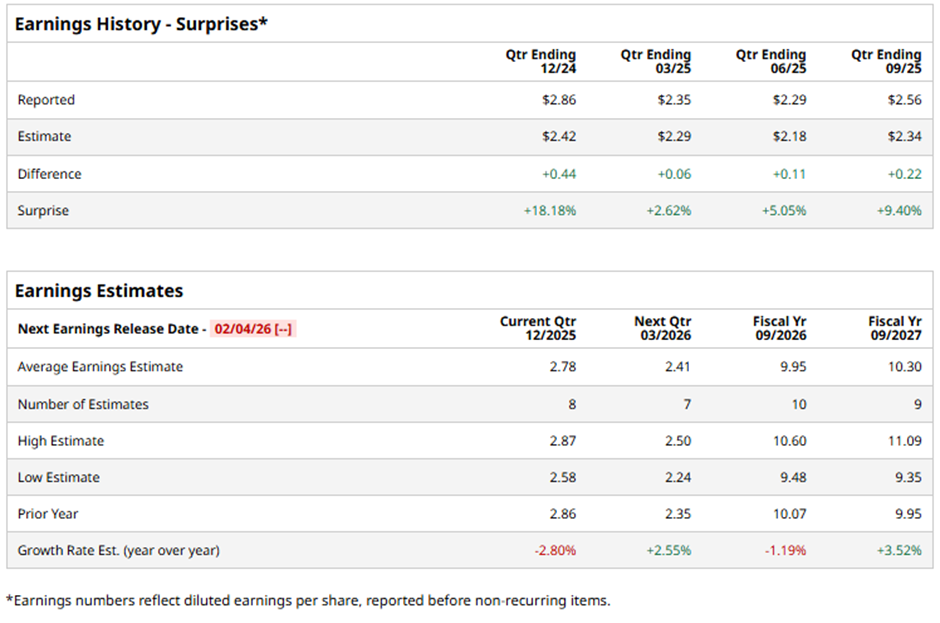

The Santa Clara, California-based company is slated to announce its fiscal Q1 2026 results soon. Ahead of this event, analysts expect QCOM to report an EPS of $2.78, down 2.8% from $2.86 in the year-ago quarter. However, it has exceeded Wall Street's earnings expectations in the past four quarters.

For fiscal 2026, analysts expect the chip designer to report EPS of $9.95, a decline of 1.2% from $10.07 in fiscal 2025. Nevertheless, EPS is anticipated to grow 3.5% year-over-year to $10.30 in fiscal 2027.

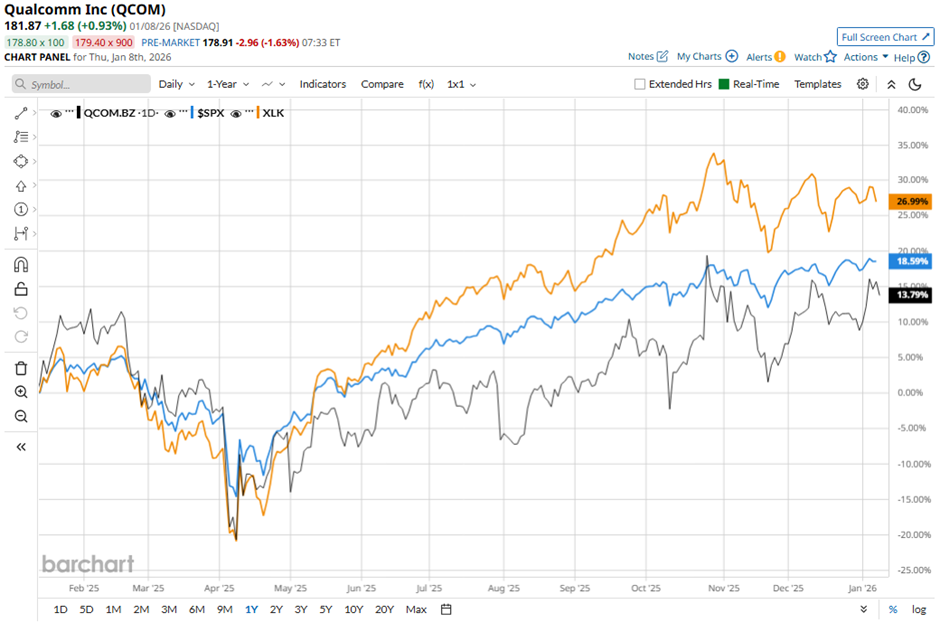

QCOM stock has returned 14.3% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) nearly 17% gain and the State Street Technology Select Sector SPDR ETF's (XLK) 23.4% rise over the same period.

Despite reporting better-than-expected Q4 2025 adjusted EPS of $3 and revenue of $11.27 billion on Nov. 5, Qualcomm shares fell 3.6% the next day because investors focused on warning of a potential loss of Samsung modem business next year. The management said Qualcomm expects its modem share in Samsung’s Galaxy S26 lineup to drop to 75% from 100% on the Galaxy S25.

Analysts' consensus view on QCOM stock remains moderately optimistic, with a "Moderate Buy" rating overall. Out of 29 analysts covering the stock, 13 recommend a "Strong Buy," one "Moderate Buy," 14 "Holds," and one has a "Strong Sell." The average analyst price target for QUALCOMM is $193.95, suggesting a potential upside of 6.6% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 Analyst Is Betting That Palantir Stock Can Gain Another 20% in 2026

- Missed the AI Rally? Jefferies Says CrowdStrike and These 3 Other Cybersecurity Stocks Could Be Next

- Nvidia Is Giving Tesla a Run for Its Money with Robotaxis. Which Is the Better Stock to Buy Now?

- The 3 Best Cannabis Stocks to Buy for 2026