Meta trades at $718.60 per share and has stayed right on track with the overall market, gaining 22.7% over the last six months. At the same time, the S&P 500 has returned 22.7%.

Is now the time to buy META? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On Meta?

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ:META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Reality Labs.

1. Eye-Popping Growth in Customer Spending

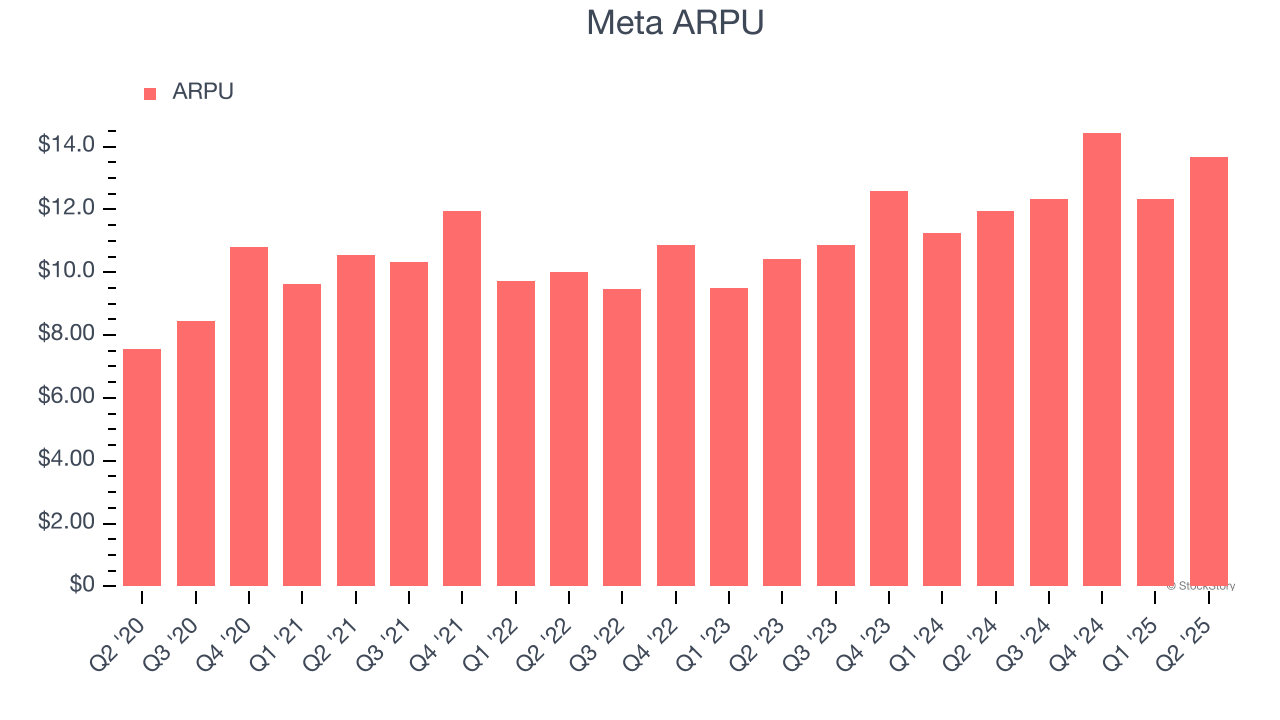

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Meta’s audience and its ad-targeting capabilities.

Meta’s ARPU growth has been exceptional over the last two years, averaging 14.5%. Its ability to increase monetization while growing its daily active people demonstrates its platform’s value, as its users are spending significantly more than last year.

2. Outstanding Long-Term EPS Growth

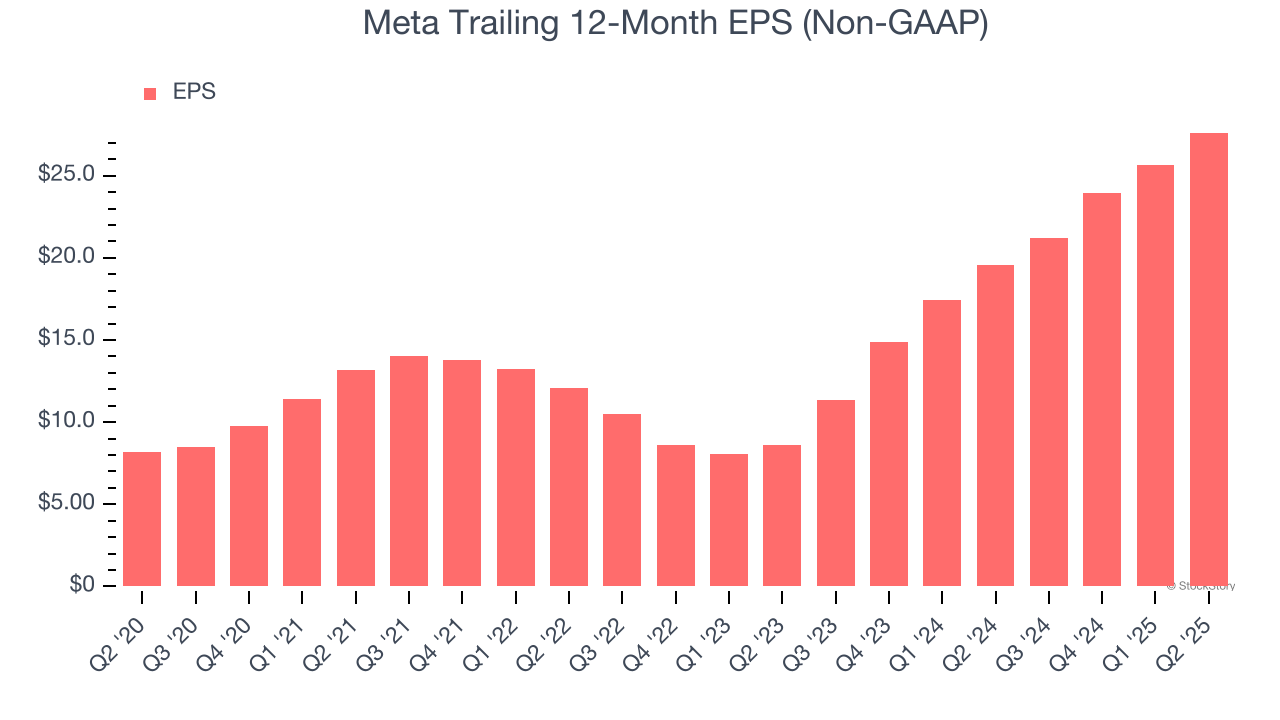

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Meta’s EPS grew at an astounding 31.8% compounded annual growth rate over the last three years, higher than its 14.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

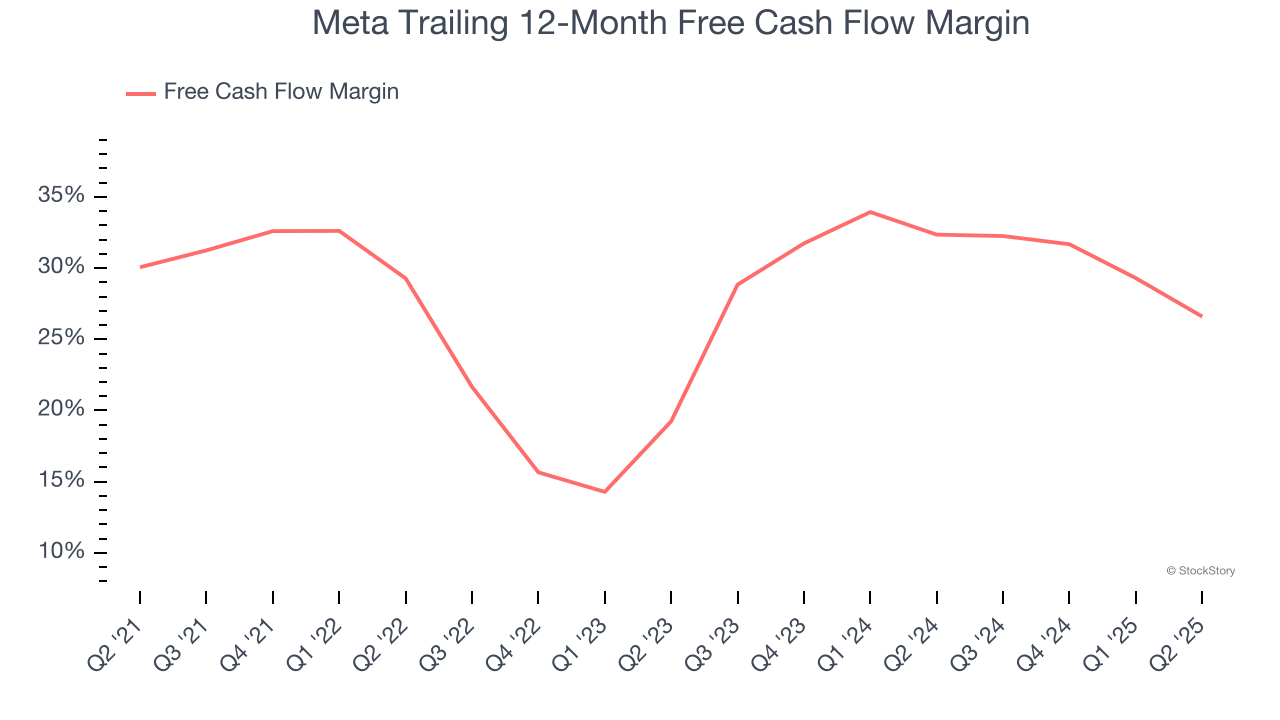

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Meta has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging 29.2% over the last two years.

Final Judgment

These are just a few reasons why we're bullish on Meta, but at $718.60 per share (or 14.4× forward EV/EBITDA), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.