Young adult apparel retailer Abercrombie & Fitch (NYSE:ANF) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 6.8% year on year to $1.29 billion. The company expects next quarter’s revenue to be around $1.66 billion, close to analysts’ estimates. Its GAAP profit of $2.36 per share was 9.4% above analysts’ consensus estimates.

Is now the time to buy Abercrombie and Fitch? Find out by accessing our full research report, it’s free for active Edge members.

Abercrombie and Fitch (ANF) Q3 CY2025 Highlights:

- Revenue: $1.29 billion vs analyst estimates of $1.28 billion (6.8% year-on-year growth, 0.9% beat)

- EPS (GAAP): $2.36 vs analyst estimates of $2.16 (9.4% beat)

- Adjusted EBITDA: $193.6 million vs analyst estimates of $191.2 million (15% margin, 1.2% beat)

- Revenue Guidance for Q4 CY2025 is $1.66 billion at the midpoint, roughly in line with what analysts were expecting

- EPS (GAAP) guidance for the full year is $10.35 at the midpoint, beating analyst estimates by 2.9%

- Operating Margin: 12%, down from 14.8% in the same quarter last year

- Free Cash Flow Margin: 10.2%, up from 7.6% in the same quarter last year

- Same-Store Sales rose 3% year on year (16% in the same quarter last year)

- Market Capitalization: $3.09 billion

Fran Horowitz, Chief Executive Officer, said, “We achieved three years of consecutive quarterly sales growth, delivering record third quarter net sales, with 7% growth to last year. Hollister brands grew 16% on a strong finish to back-to-school and fall seasonal transition. Abercrombie brands made sequential progress in-line with our expectations, and we are tightly managing inventory as we aim for fourth quarter brand net sales to be approximately flat to last year’s record. On the bottom line, we delivered a 12.0% operating margin including important investments in marketing, digital and technology, in addition to 210 basis points of adverse tariff impact. We exceeded our expectations on earnings per share, while also returning $100 million to shareholders in the third quarter, our seventh consecutive quarter of share repurchases.

Company Overview

Founded as an outdoor and sporting brand, Abercrombie & Fitch (NYSE:ANF) evolved to become a specialty retailer that sells its own brand of fashionable clothing to young adults.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $5.18 billion in revenue over the past 12 months, Abercrombie and Fitch is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

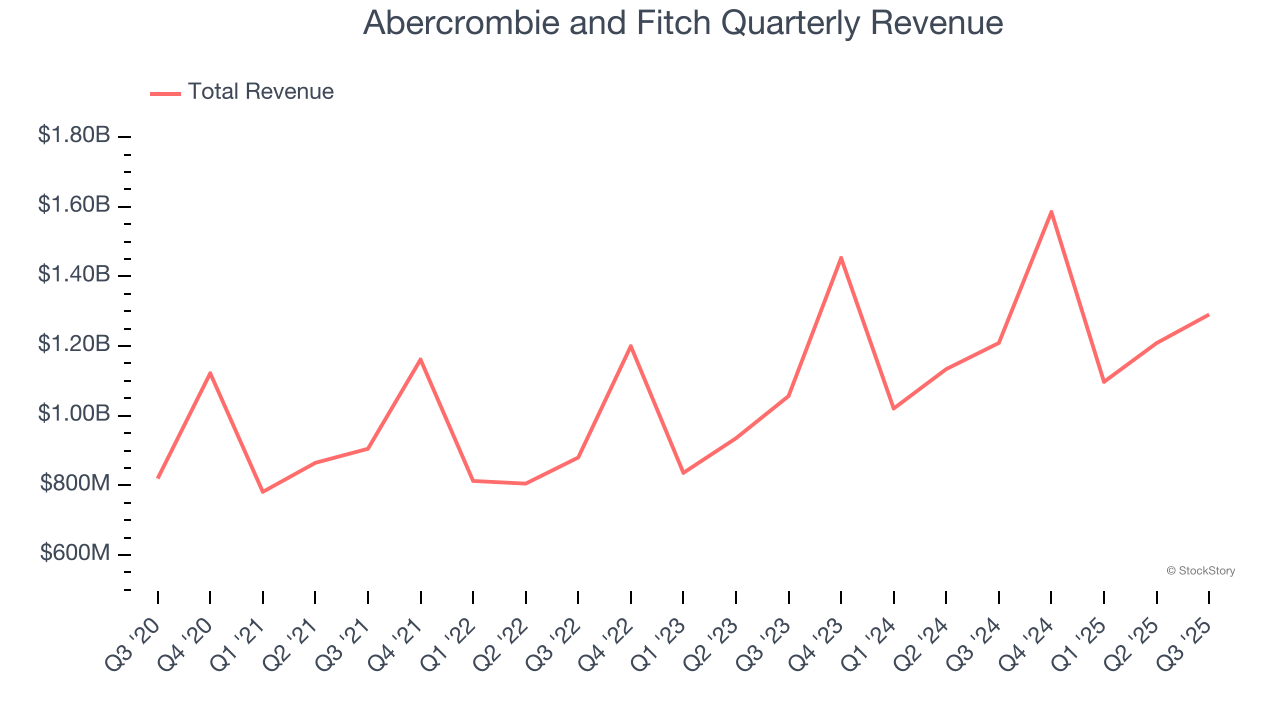

As you can see below, Abercrombie and Fitch’s 12.3% annualized revenue growth over the last three years (we compare to 2019 to normalize for COVID-19 impacts) was decent as it opened new stores and increased sales at existing, established locations.

This quarter, Abercrombie and Fitch reported year-on-year revenue growth of 6.8%, and its $1.29 billion of revenue exceeded Wall Street’s estimates by 0.9%. Company management is currently guiding for a 5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is above average for the sector and indicates the market is baking in some success for its newer products.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

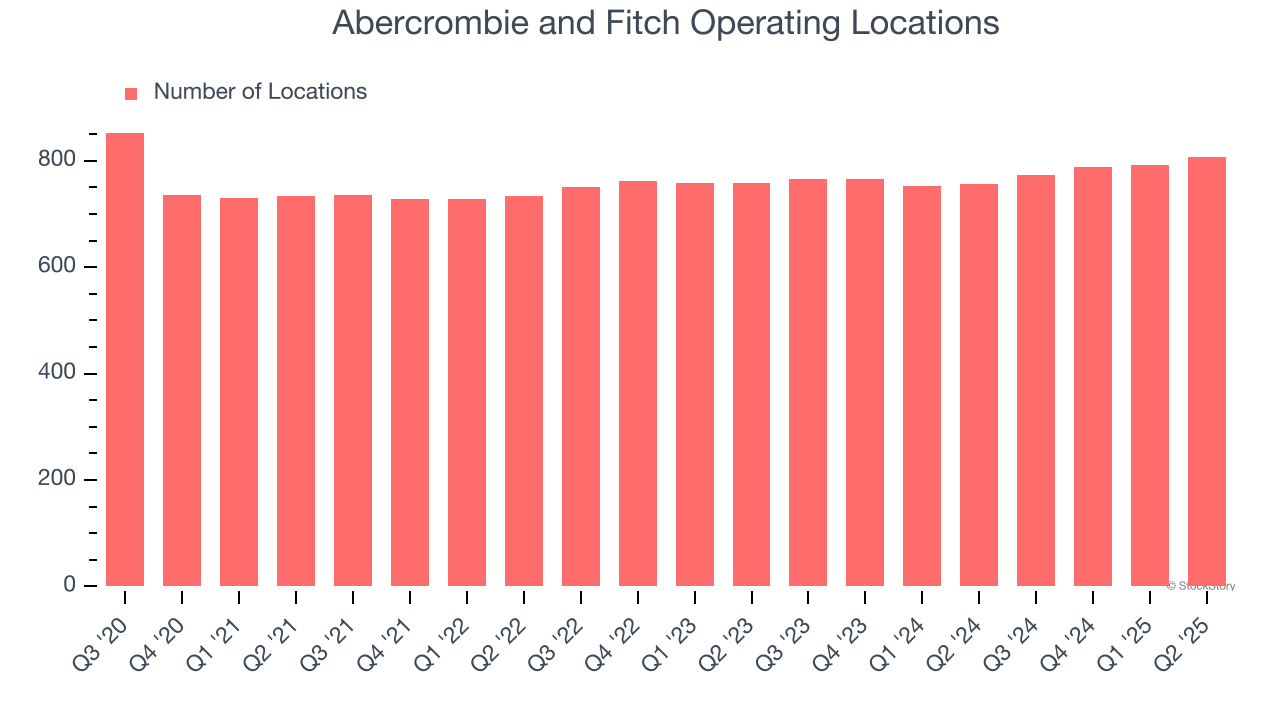

Over the last two years, Abercrombie and Fitch opened new stores quickly, averaging 2.2% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that Abercrombie and Fitch reports its store count intermittently, so some data points are missing in the chart below.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

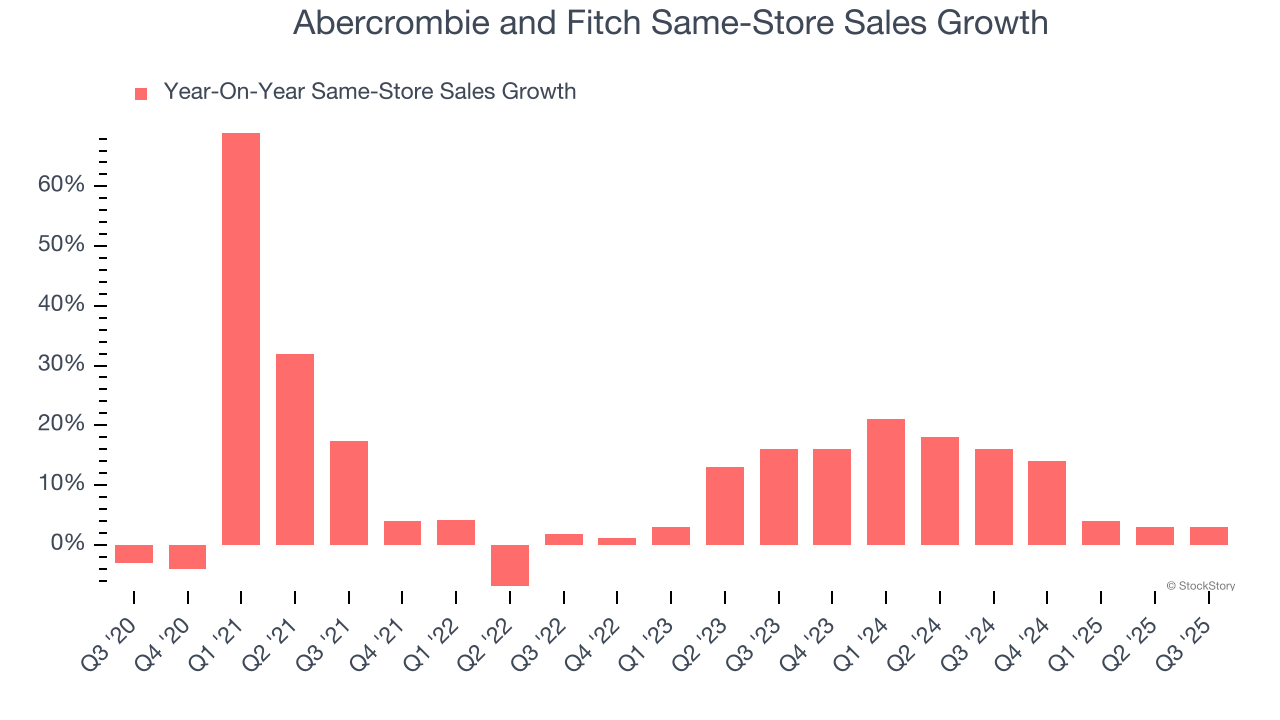

Abercrombie and Fitch has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 11.9%. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Abercrombie and Fitch multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Abercrombie and Fitch’s same-store sales rose 3% year on year. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Abercrombie and Fitch can reaccelerate growth.

Key Takeaways from Abercrombie and Fitch’s Q3 Results

It was great to see Abercrombie and Fitch’s full-year EPS guidance top analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates on healthy same-store sales. Overall, this print had some key positives. The stock traded up 17.2% to $77.21 immediately after reporting.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.