![]()

What a brutal six months it’s been for onsemi. The stock has dropped 39.3% and now trades at $42.72, rattling many shareholders. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in onsemi, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Despite the more favorable entry price, we're cautious about onsemi. Here are three reasons why ON doesn't excite us and a stock we'd rather own.

Why Is onsemi Not Exciting?

Spun out of Motorola in 1999 and built through a series of acquisitions, onsemi (NASDAQ:ON) is a global provider of analog chips specializing in autos, industrial applications, and power management in cloud data centers.

1. Long-Term Revenue Growth Disappoints

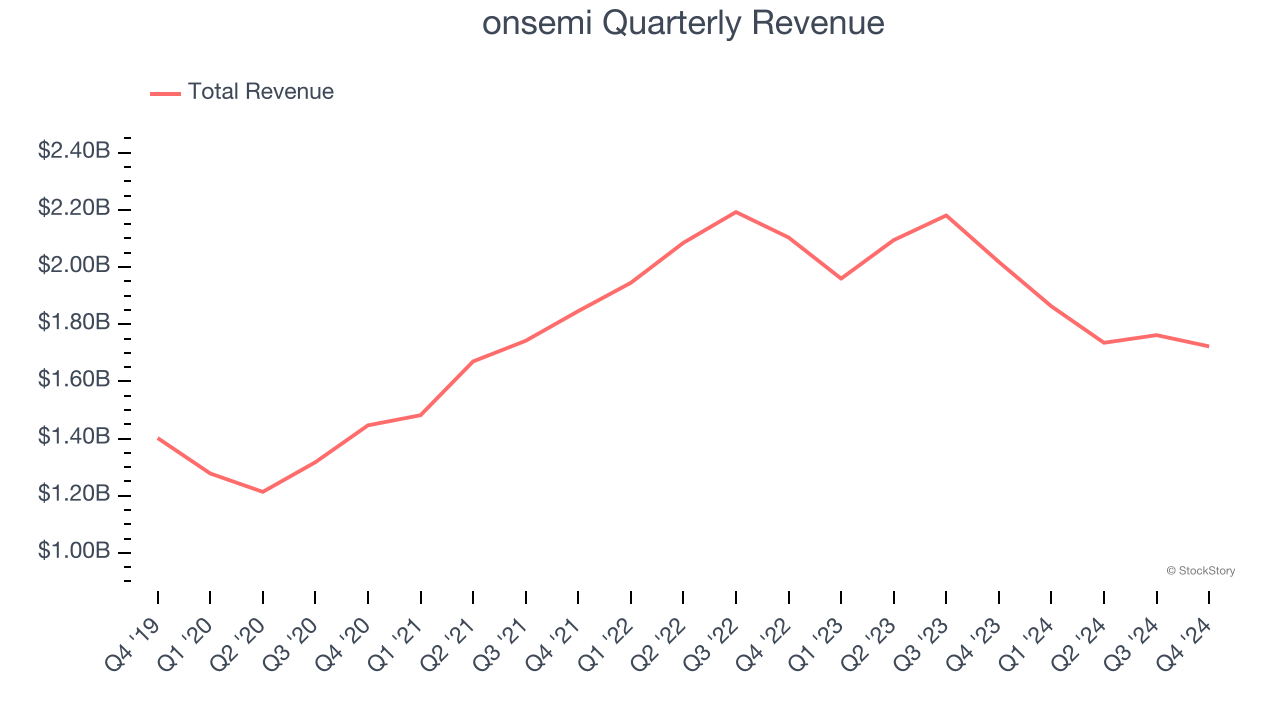

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, onsemi’s 5.1% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the semiconductor sector. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect onsemi’s revenue to drop by 16.1%, a decrease from its 7.8% annualized declines for the past two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

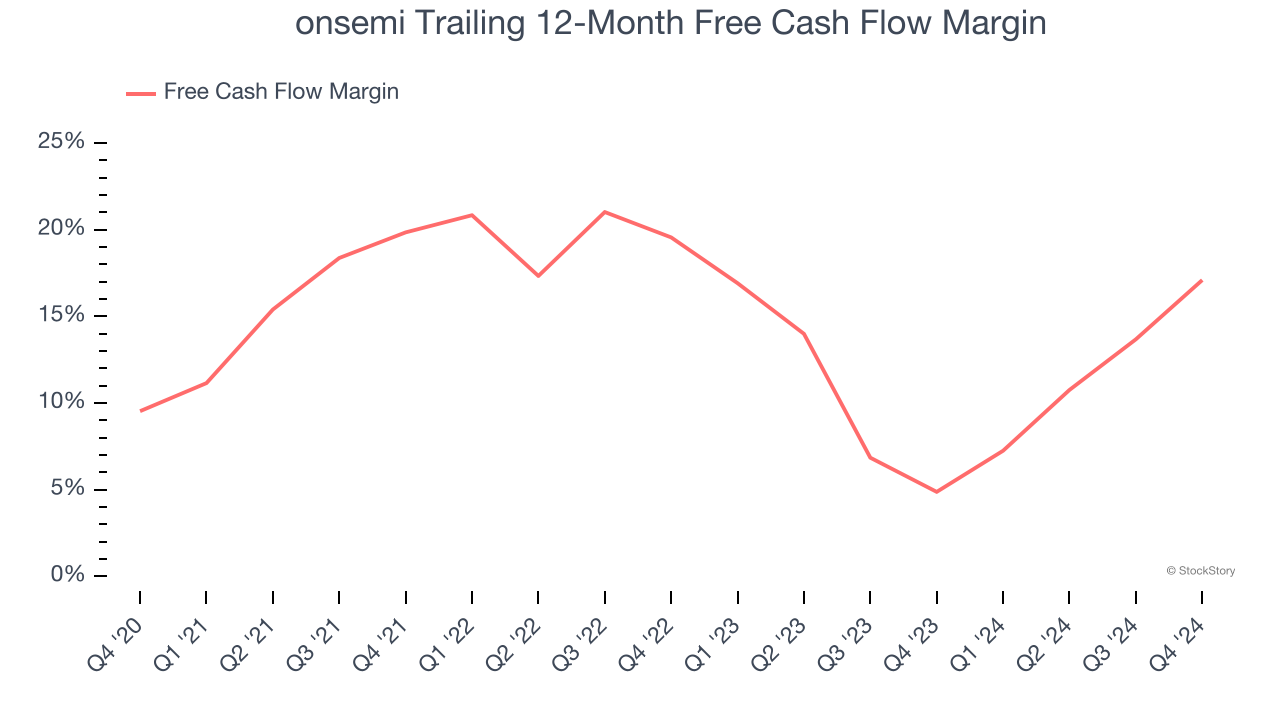

onsemi has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 10.5%, subpar for a semiconductor business. The divergence from its good operating margin stems from its capital-intensive business model, which requires onsemi to make large cash investments in working capital and capital expenditures.

Final Judgment

onsemi’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 10.3× forward price-to-earnings (or $42.72 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at the most dominant software business in the world.

Stocks We Would Buy Instead of onsemi

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.