The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Richardson Electronics (NASDAQ:RELL) and the rest of the specialty equipment distributors stocks fared in Q4.

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

The 8 specialty equipment distributors stocks we track reported a slower Q4. As a group, revenues missed analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 11.4% since the latest earnings results.

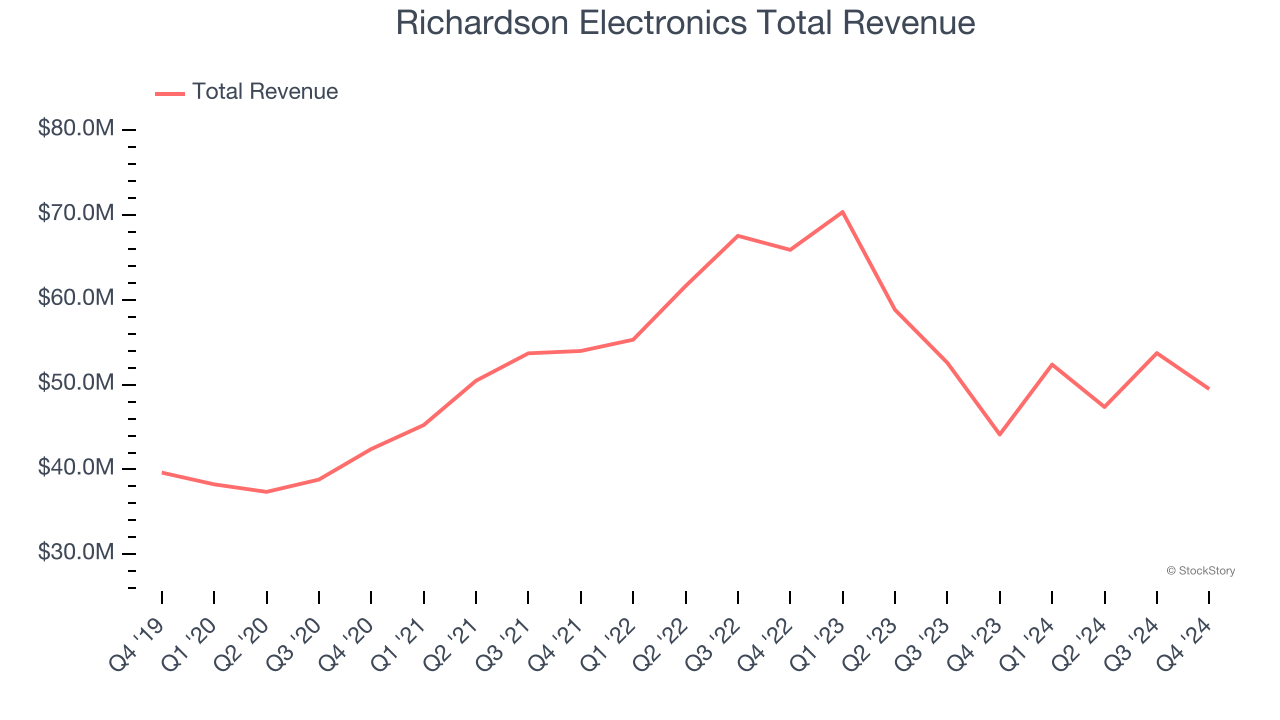

Weakest Q4: Richardson Electronics (NASDAQ:RELL)

Founded in 1947, Richardson Electronics (NASDAQ:RELL) is a distributor of power grid and microwave tubes as well as consumables related to those products.

Richardson Electronics reported revenues of $49.49 million, up 12.1% year on year. This print fell short of analysts’ expectations by 3.5%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EBITDA and EPS estimates.

“Our second quarter results included new program wins and continued improvement in demand across our GES and PMT markets. These trends drove a 129%, or $3.4 million year-over-year increase in GES sales and an 85% increase in sales to our semi-conductor wafer fab customers. While Canvys sales declined by $0.4 million year-over-year, we expect a pick-up in Canvys sales for the remainder of fiscal 2025," said Edward J. Richardson, Chairman, CEO, and President.

The stock is down 26.5% since reporting and currently trades at $10.81.

Read our full report on Richardson Electronics here, it’s free.

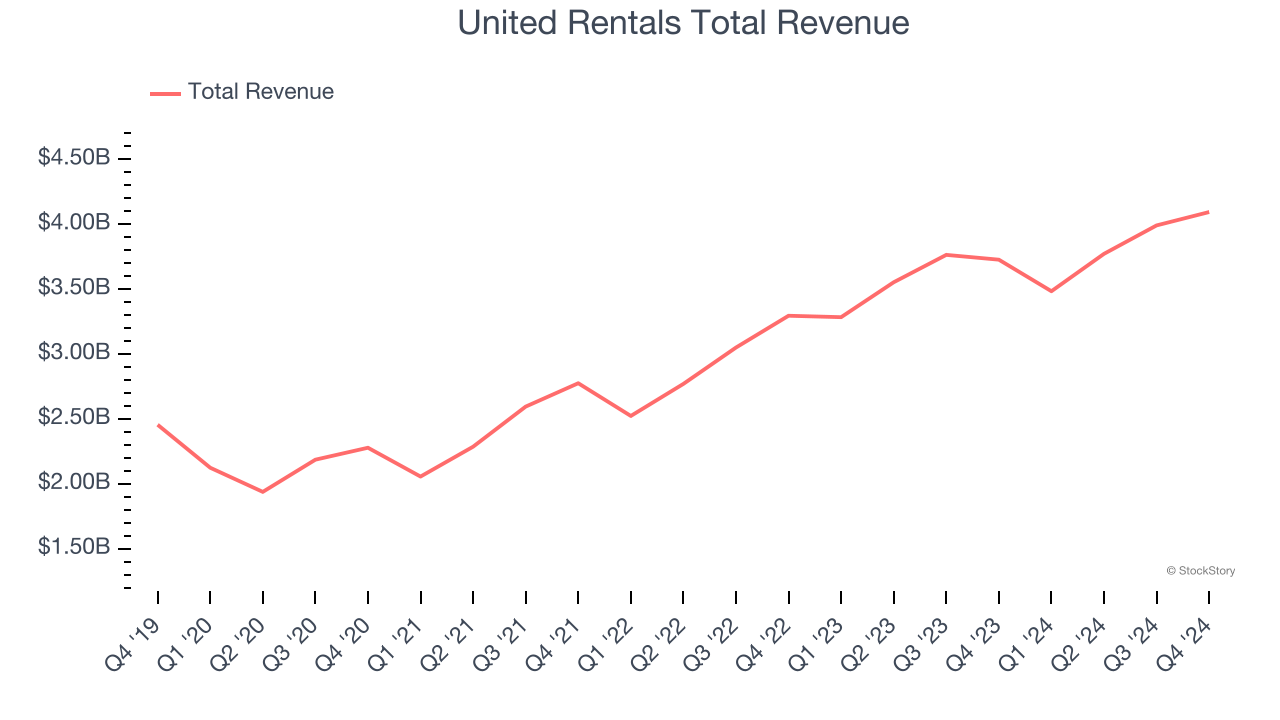

Best Q4: United Rentals (NYSE:URI)

Owning the largest rental fleet in the world, United Rentals (NYSE:URI) provides equipment rental and related services to construction, industrial, and infrastructure industries.

United Rentals reported revenues of $4.10 billion, up 9.8% year on year, outperforming analysts’ expectations by 3.9%. The business had a strong quarter with a solid beat of analysts’ organic revenue and operating income estimates.

United Rentals delivered the biggest analyst estimates beat among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 17.5% since reporting. It currently trades at $625.06.

Is now the time to buy United Rentals? Access our full analysis of the earnings results here, it’s free.

Karat Packaging (NASDAQ:KRT)

Founded as Lollicup, Karat Packaging (NASDAQ: KRT) distributes and manufactures environmentally-friendly disposable foodservice packaging solutions.

Karat Packaging reported revenues of $101.6 million, up 6.3% year on year, falling short of analysts’ expectations by 0.6%. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 7.6% since the results and currently trades at $26.58.

Read our full analysis of Karat Packaging’s results here.

SiteOne (NYSE:SITE)

Known for distributing John Deere tractors and LESCO turf care products, SiteOne Landscape Supply (NYSE:SITE) provides landscaping products and services to professionals, including irrigation, lighting, and nursery supplies.

SiteOne reported revenues of $1.01 billion, up 5% year on year. This result beat analysts’ expectations by 1.3%. It was a strong quarter as it also put up an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 9.3% since reporting and currently trades at $120.94.

Read our full, actionable report on SiteOne here, it’s free.

Alta (NYSE:ALTG)

Founded in 1984, Alta Equipment Group (NYSE:ALTG) is a provider of industrial and construction equipment and services across the Midwest and Northeast United States.

Alta reported revenues of $498.1 million, down 4.5% year on year. This number surpassed analysts’ expectations by 2.6%. Aside from that, it was a slower quarter as it produced a significant miss of analysts’ adjusted operating income estimates.

The stock is down 11.7% since reporting and currently trades at $4.50.

Read our full, actionable report on Alta here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.