Let’s dig into the relative performance of Target Hospitality (NASDAQ:TH) and its peers as we unravel the now-completed Q4 travel and vacation providers earnings season.

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 19 travel and vacation providers stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was 6.9% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.1% since the latest earnings results.

Target Hospitality (NASDAQ:TH)

Building mini-communities at places such as oil drilling sites, Target Hospitality (NASDAQ:TH) is a provider of specialty workforce lodging accommodations and services.

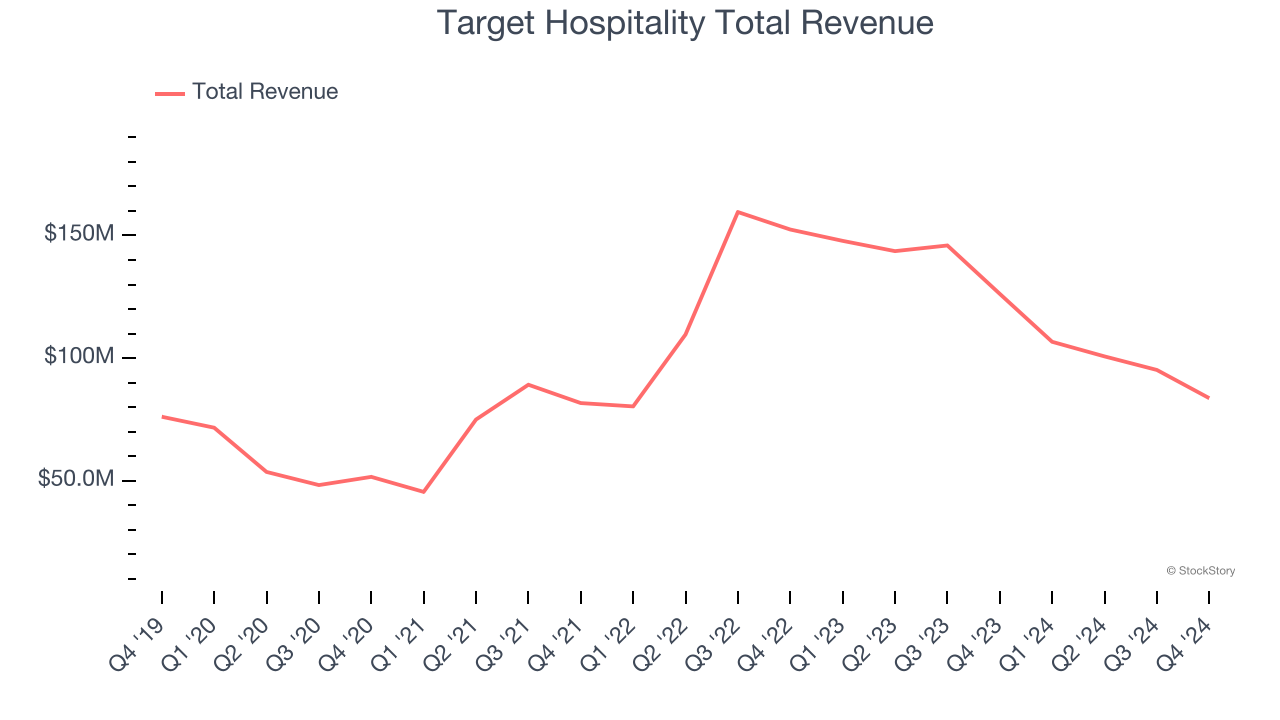

Target Hospitality reported revenues of $83.69 million, down 33.7% year on year. This print exceeded analysts’ expectations by 4.5%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

"Our 2024 performance further illustrates our ability to deliver strong results through a variety of business cycles and dynamic changes in customer demand. This operational flexibility has consistently supported the achievement of our financial goals, while allowing us to simultaneously remain focused on pursuing strategic growth initiatives," stated Brad Archer, President and Chief Executive Officer.

Target Hospitality delivered the weakest full-year guidance update of the whole group. The stock is up 6.7% since reporting and currently trades at $6.54.

Is now the time to buy Target Hospitality? Access our full analysis of the earnings results here, it’s free.

Best Q4: Pursuit (NYSE:PRSU)

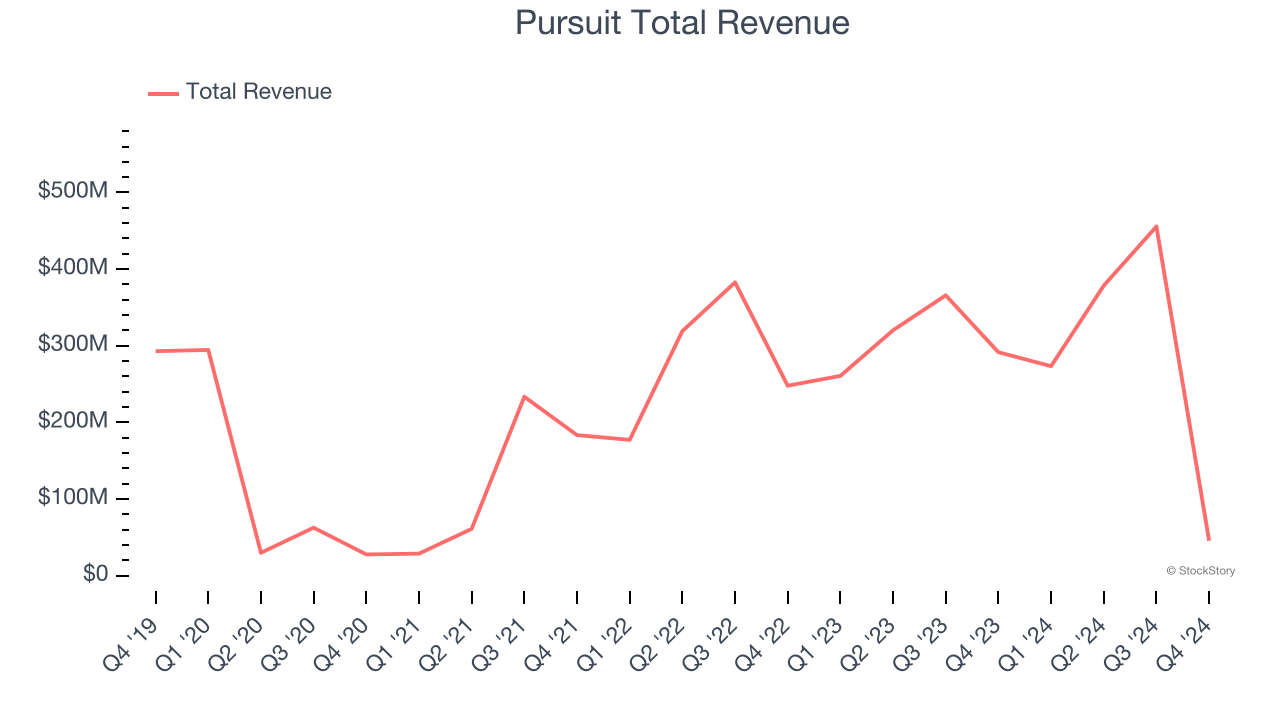

With attractions ranging from glacier tours in the Canadian Rockies to an oceanfront geothermal lagoon in Iceland, Pursuit Attractions and Hospitality (NYSE:PRSU) operates iconic travel experiences, experiential marketing services, and exhibition management across North America and Europe.

Pursuit reported revenues of $45.8 million, down 84.3% year on year, outperforming analysts’ expectations by 8.8%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 4.7% since reporting. It currently trades at $35.39.

Is now the time to buy Pursuit? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Hyatt Hotels (NYSE:H)

Founded in 1957, Hyatt Hotels (NYSE:H) is a global hospitality company with a portfolio of 20 premier brands and over 950 properties across 65 countries.

Hyatt Hotels reported revenues of $1.60 billion, down 3.5% year on year, falling short of analysts’ expectations by 3.1%. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Hyatt Hotels delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 24.8% since the results and currently trades at $122.05.

Read our full analysis of Hyatt Hotels’s results here.

Marriott Vacations (NYSE:VAC)

Spun off from Marriott International in 1984, Marriott Vacations (NYSE:VAC) is a vacation company providing leisure experiences for travelers around the world.

Marriott Vacations reported revenues of $1.33 billion, up 11.1% year on year. This result surpassed analysts’ expectations by 6.7%. Zooming out, it was a mixed quarter as it also produced a decent beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

The stock is down 24.6% since reporting and currently trades at $64.49.

Read our full, actionable report on Marriott Vacations here, it’s free.

Choice Hotels (NYSE:CHH)

With almost 100% of its properties under franchise agreements, Choice Hotels (NYSE:CHH) is a hotel franchisor known for its diverse brand portfolio including Comfort Inn, Quality Inn, and Clarion.

Choice Hotels reported revenues of $389.8 million, up 8.8% year on year. This print topped analysts’ expectations by 2.8%. It was a strong quarter as it also put up a solid beat of analysts’ adjusted operating income estimates.

The stock is down 10% since reporting and currently trades at $132.91.

Read our full, actionable report on Choice Hotels here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.