Looking back on insurance stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including Hartford (NYSE:HIG) and its peers.

The insurance industry absorbs and diversifies risk, providing financial protection against unforeseen life, health, property, and liability events. Profits come from underwriting—collecting more in premiums than paid in claims—and investing the 'float'. This cyclical industry benefits from 'hard markets' with strong pricing power and higher interest rates that enhance investment income. AI adoption is improving underwriting through sophisticated data analysis and reducing costs via automation. However, 'soft markets' and low rates create headwinds, while the industry faces elevated claims costs from climate catastrophes, inflation, and rising litigation expenses.

The 58 insurance stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 1.1%.

While some insurance stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.3% since the latest earnings results.

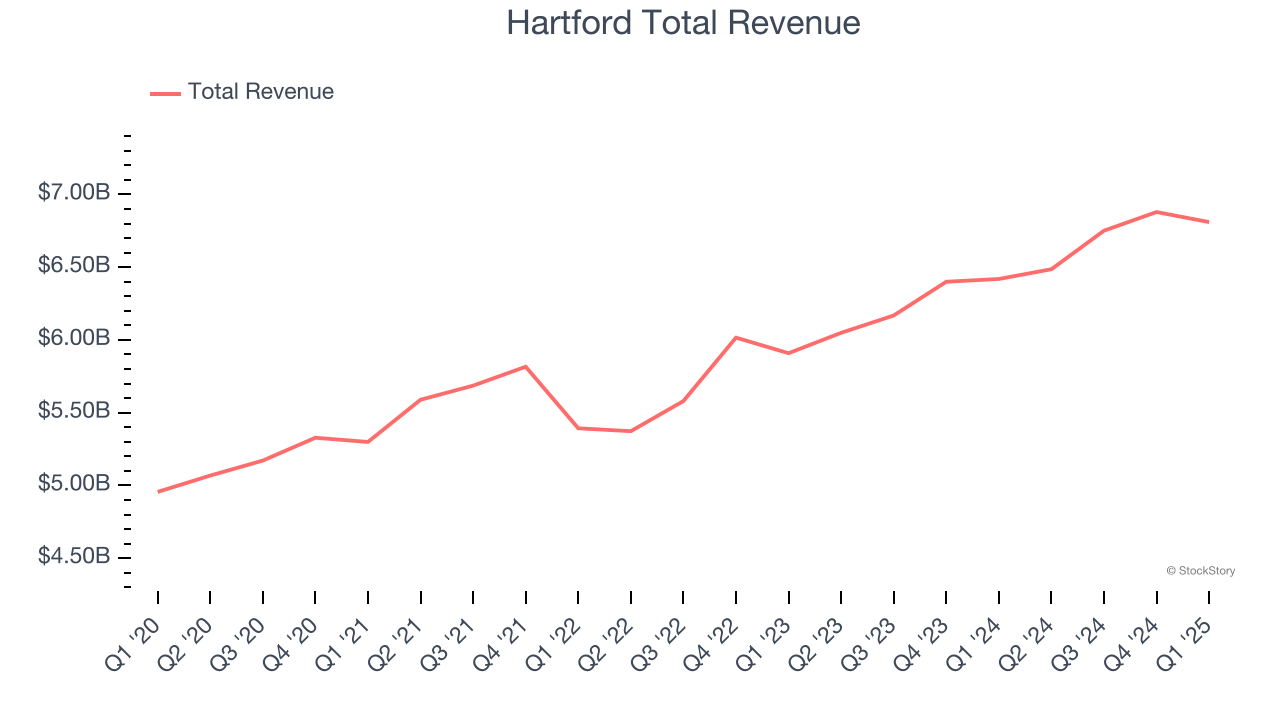

Hartford (NYSE:HIG)

Recognizable by its iconic stag logo that dates back to 1810, The Hartford (NYSE:HIG) provides property and casualty insurance, group benefits, and investment products to individuals and businesses across the United States.

Hartford reported revenues of $6.81 billion, up 6.1% year on year. This print fell short of analysts’ expectations by 2.3%. Overall, it was a slower quarter for the company with a significant miss of analysts’ book value per share estimates and EPS in line with analysts’ estimates.

“The Hartford is off to a strong start in 2025, delivering a trailing 12-month core earnings ROE of 16.2 percent,” said The Hartford’s Chairman and CEO Christopher Swift.

The stock is down 4.8% since reporting and currently trades at $121.87.

Read our full report on Hartford here, it’s free.

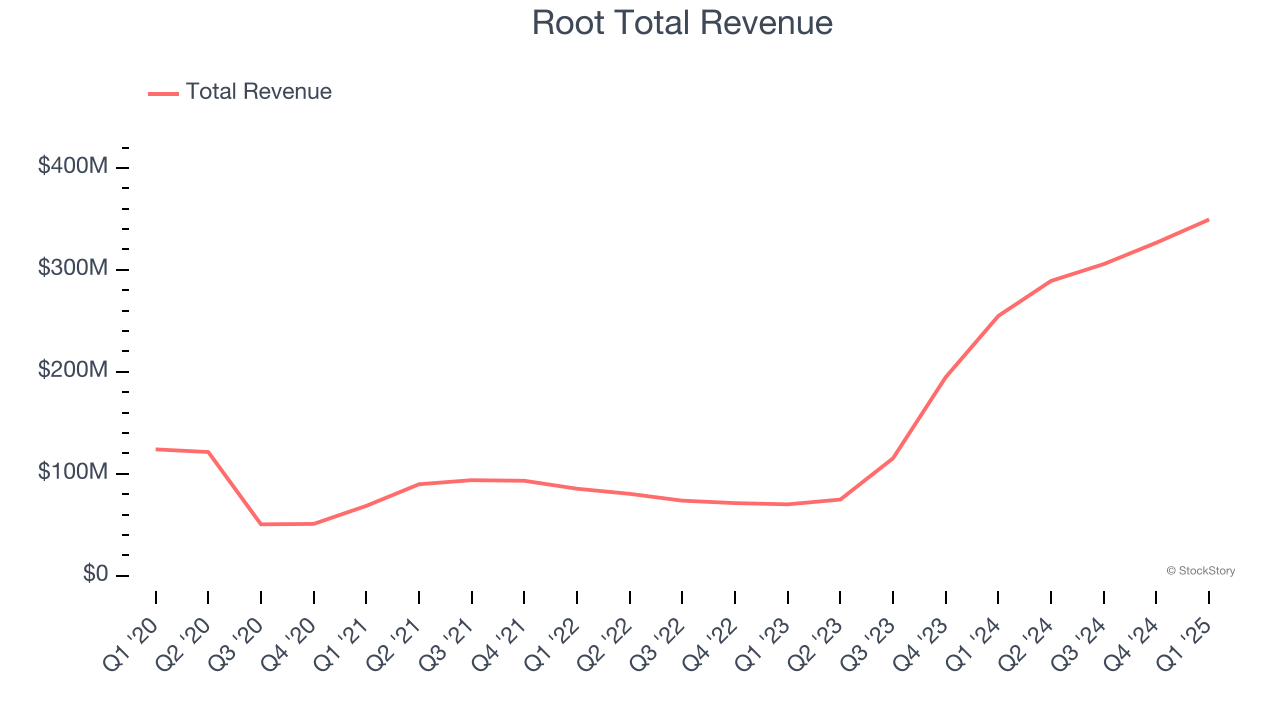

Best Q1: Root (NASDAQ:ROOT)

Pioneering a data-driven approach that rewards good driving habits, Root (NASDAQ:ROOT) is a technology-driven auto insurance company that uses mobile apps to acquire customers and data science to price policies based on individual driving behavior.

Root reported revenues of $349.4 million, up 37.1% year on year, outperforming analysts’ expectations by 9.1%. The business had an incredible quarter with an impressive beat of analysts’ EPS and net premiums earned estimates.

The market seems unhappy with the results as the stock is down 12.1% since reporting. It currently trades at $123.30.

Is now the time to buy Root? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Equitable Holdings (NYSE:EQH)

Tracing its roots back to 1859 as one of America's oldest financial institutions, Equitable Holdings (NYSE:EQH) provides retirement planning, asset management, and life insurance products through its two main franchises, Equitable and AllianceBernstein.

Equitable Holdings reported revenues of $3.78 billion, up 4% year on year, falling short of analysts’ expectations by 5.7%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

The stock is flat since the results and currently trades at $53.18.

Read our full analysis of Equitable Holdings’s results here.

Radian Group (NYSE:RDN)

Founded during the housing boom of 1977 and weathering multiple real estate cycles since, Radian Group (NYSE:RDN) provides mortgage insurance and real estate services, helping lenders manage risk and homebuyers achieve affordable homeownership.

Radian Group reported revenues of $318.1 million, down 3.4% year on year. This result came in 3% below analysts' expectations. Overall, it was a softer quarter as it also recorded EPS in line with analysts’ estimates.

The stock is up 5.4% since reporting and currently trades at $35.01.

Read our full, actionable report on Radian Group here, it’s free.

AIG (NYSE:AIG)

With roots dating back to 1919 when it began as a small insurance agency in Shanghai, China, AIG (NYSE:AIG) is a global insurance organization that provides commercial and personal insurance solutions to businesses and individuals across more than 200 countries.

AIG reported revenues of $6.78 billion, flat year on year. This print was in line with analysts’ expectations. More broadly, it was a mixed quarter as it also logged an impressive beat of analysts’ EPS estimates but a significant miss of analysts’ book value per share estimates.

The stock is up 2.9% since reporting and currently trades at $83.07.

Read our full, actionable report on AIG here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.