Latest News

On a day marked by deepening global uncertainty and a sharp spike in energy costs, the healthcare sector emerged as the primary beneficiary of a massive "risk-off" migration by institutional investors. As of the market close on March 10, 2026, the Healthcare Select Sector SPDR Fund (NYSEARCA:XLV) gained 1%

Via MarketMinute · March 10, 2026

Barclays increased the price target on the stock to $4 from $3 and kept an ‘Overweight’ rating on the shares.

Via Stocktwits · March 10, 2026

TransAct Technologies Inc. (NASDAQ:TACT) Reports Q4 2025 Revenue Miss and Wider-Than-Expected Losschartmill.com

Via Chartmill · March 10, 2026

An exciting new partnership should help to fuel the adtech platform's expansion.

Via The Motley Fool · March 10, 2026

loanDepot Inc. (NYSE:LDI) Reports Q4 2025 Revenue Miss and Wider Loss, Stock Fallschartmill.com

Via Chartmill · March 10, 2026

Oracle Corp (NYSE:ORCL) Reports Q3 2026 Earnings Beat, Stock Surges on Accelerating Growthchartmill.com

Via Chartmill · March 10, 2026

Concrete Pumping Holdings (NASDAQ:BBCP) Reports Q1 2026 Revenue Beat Amid Narrower-Than-Expected Losschartmill.com

Via Chartmill · March 10, 2026

It reported third quarter revenue of $408.0 million which fell well short of analyst expectations of $475.65 million, as per data from Fiscal.ai.

Via Stocktwits · March 10, 2026

The dominant narrative of the 2020s—a market driven by a handful of trillion-dollar technology titans—is facing its most significant challenge yet. As of March 10, 2026, the tide has officially turned, with investors aggressively rotating out of concentrated, market-cap-weighted indices in favor of equal-weight strategies. This shift is

Via MarketMinute · March 10, 2026

Westrock Coffee Co (NASDAQ:WEST) Reports Q4 Revenue Beat and Wider Loss, Provides 2026 Outlookchartmill.com

Via Chartmill · March 10, 2026

Blend Labs Inc (NYSE:BLND) Reports In-Line Q4 Revenue and Breakeven Non-GAAP EPSchartmill.com

Via Chartmill · March 10, 2026

Infinity Natural Resources (NYSE:INR) Beats Q4 Estimates, Guides for 70% Production Growth in 2026chartmill.com

Via Chartmill · March 10, 2026

Finance of America Cos Inc-A (NYSE:FOA) Reports Mixed Q4 2025 Results with Earnings Beat, Revenue Misschartmill.com

Via Chartmill · March 10, 2026

Domo Inc. (NASDAQ:DOMO) Stock Surges 37% on Surprise Q4 Profit and Record Billingschartmill.com

Via Chartmill · March 10, 2026

The U.S. labor market sent a seismic shock through global financial markets on Tuesday, March 10, 2026, as the Bureau of Labor Statistics reported a staggering contraction in non-farm payrolls for February. While economists had braced for a modest gain of roughly 70,000 jobs, the actual figure plummeted

Via MarketMinute · March 10, 2026

Shoulder Innovations Inc (NYSE:SI) Stock Surges on Strong Revenue Beat and 65% Growthchartmill.com

Via Chartmill · March 10, 2026

Shares of Okta, Inc. (OKTA:NASDAQ) surged more than 11% in Tuesday’s trading session following a powerhouse fourth-quarter earnings report that silenced critics of the maturing software-as-a-service (SaaS) sector. The identity management leader posted a "double beat" on revenue and profit margins, signaling that enterprise spending on security remains

Via MarketMinute · March 10, 2026

...

Via Benzinga · March 10, 2026

Via Benzinga · March 10, 2026

Herc Holdings delivers equipment rental and value-added services to construction, industrial, and specialty markets nationwide.

Via The Motley Fool · March 10, 2026

Today, March 10, 2026, a surprise first-ever profit and record deliveries are reshaping how investors size up this EV maker.

Via The Motley Fool · March 10, 2026

Shares of Palantir Technologies (NYSE: PLTR) faced a sharp reversal on Tuesday, March 10, 2026, dropping 3.41% to close at $151.09. The decline came during a session where the broader technology sector enjoyed a robust rally, with the Nasdaq Composite climbing 1.4% on renewed optimism surrounding enterprise

Via MarketMinute · March 10, 2026

Via Benzinga · March 10, 2026

NVIDIA (NASDAQ: NVDA) shares climbed 2.7% on March 10, 2026, as investors aggressively positioned themselves ahead of the company’s annual GTC AI Conference. The gain, which outperformed the broader indices, underscores the market's unwavering reliance on the semiconductor giant as the primary engine of the artificial intelligence revolution.

Via MarketMinute · March 10, 2026

Via Benzinga · March 10, 2026

The global financial markets witnessed a powerful "relief rally" on Tuesday, March 10, 2026, as a cooling of geopolitical friction in the Middle East sparked a massive rotation back into high-growth technology sectors. Leading the charge was the semiconductor industry, which acted as the primary engine for the tech-heavy Nasdaq

Via MarketMinute · March 10, 2026

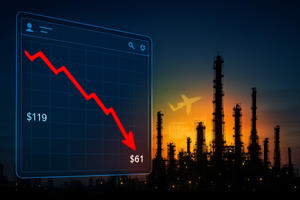

NEW YORK — In a dramatic reversal that has caught energy traders off guard, West Texas Intermediate (WTI) crude oil prices plummeted on Tuesday, March 10, 2026, falling into the $81 to $90 range after hitting a terrifying weekend high of nearly $119 per barrel. This sharp 25% retreat from the

Via MarketMinute · March 10, 2026

In a dramatic reversal of fortune, the U.S. stock market staged a powerful relief rally on Tuesday, March 10, 2026, as investors seized on optimistic rhetoric regarding the conflict in the Middle East. After opening the session in deep red territory following a week of escalating hostilities, major indices

Via MarketMinute · March 10, 2026

Via Benzinga · March 10, 2026

Via Benzinga · March 10, 2026

Shares of drone and munitions maker AeroVironment tumbled late Tuesday after the company cut its outlook with its third-quarter miss.

Via Investor's Business Daily · March 10, 2026

Via Benzinga · March 10, 2026

Via Benzinga · March 10, 2026

The S&P 500 Index ($SPX ) (SPY ) on Tuesday fell -0.21%, the Dow Jones Industrial Average ($DOWI ) (DIA ) fell -0.07%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) fell -0.04%. March E-mini S&P futures (ESH26 ) fell -0.11%, and March E-mini Nasd...

Via Barchart.com · March 10, 2026

These Canadian dividend stars still trade at attractive prices and have the potential to consistently increase dividends.

Via The Motley Fool · March 10, 2026

Here's a look at why Groupon shares are down after Q4 earnings.

Via Benzinga · March 10, 2026

Broadcom looks like a smart stock to buy right now in the artificial intelligence (AI) space.

Via The Motley Fool · March 10, 2026

Via Talk Markets · March 10, 2026

Tesla is advertising several products across social media platforms that aren't X. Here's the companies and products.

Via Benzinga · March 10, 2026

Build a simple, high‑conviction TFSA portfolio for 2026 with three Canadian stocks offering stability, income, and long‑term compounding potential.

Via The Motley Fool · March 10, 2026

Upstart shares are moving higher in Tuesday's after-hours session after the company announces plans to apply for a national bank charter.

Via Benzinga · March 10, 2026

Vehicle systems manufacturer Commercial Vehicle Group (NASDAQ:CVGI) reported Q4 CY2025 results beating Wall Street’s revenue expectations, but sales fell by ...

Via StockStory · March 10, 2026

Here's a look at the details inside Evolv Technologies' Q4 earnings report.

Via Benzinga · March 10, 2026

Gold prices have surged this year even as ETFs see their biggest outflows in two years, raising questions about who's driving the rally.

Via Benzinga · March 10, 2026