Latest News

DIME COMMUNITY BANCSHARES INC (NASDAQ:DCOM) Beats Q4 Estimates with Record Revenuechartmill.com

Via Chartmill · January 21, 2026

Truist Financial Corp (NYSE:TFC) Q4 2025 Earnings Beat on EPS, Miss on Revenuechartmill.com

Via Chartmill · January 21, 2026

TE Connectivity (NYSE:TEL) Beats Q1 2026 Estimates Despite Pre-Market Dipchartmill.com

Via Chartmill · January 21, 2026

Johnson & Johnson (NYSE:JNJ) Beats Q4 Estimates but Stock Dips on 2026 Guidancechartmill.com

Via Chartmill · January 21, 2026

Midwestern regional bank Old National Bancorp (NASDAQ:ONB) fell short of the markets revenue expectations in Q4 CY2025, but sales rose 40.9% year on year to $698.6 million. Its non-GAAP profit of $0.62 per share was 4.8% above analysts’ consensus estimates.

Via StockStory · January 21, 2026

Halliburton Co. (NYSE:HAL) Beats Q4 2025 Earnings and Revenue Estimateschartmill.com

Via Chartmill · January 21, 2026

Any blockchain network that is able to surpass Ethereum could be capable of generating 1,000-fold returns.

Via The Motley Fool · January 21, 2026

PLTR Stock Garners Retail Attention On AI Infrastructure Deals At Davosstocktwits.com

Via Stocktwits · January 21, 2026

PERDOCEO EDUCATION CORP (NASDAQ:PRDO) Stands Out as an Affordable Growth Stockchartmill.com

Via Chartmill · January 21, 2026

Via Benzinga · January 21, 2026

Could Joby Aviation be the first real winner in air taxis? Here's what FAA certification, cash strength, and valuation mean for investors right now.

Via The Motley Fool · January 21, 2026

Bitcoin is trading around $89,000 as markets reel from renewed tariff threats by President Trump; liquidations stand at $867.95 million over the past 24 hours. Bitcoin ETFs saw $483.4 million in net outflows on Tuesday, while Ethereum ETFs reported $229 million in net outflows.

Via Benzinga · January 21, 2026

Property and casualty insurer Travelers (NYSE:TRV) met Wall Streets revenue expectations in Q4 CY2025, with sales up 3.1% year on year to $12.43 billion. Its non-GAAP profit of $11.13 per share was 26.8% above analysts’ consensus estimates.

Via StockStory · January 21, 2026

Investors looking to buy a beaten-down AI stock should take a closer look at this name before it starts soaring.

Via The Motley Fool · January 21, 2026

Via Benzinga · January 21, 2026

UBER TECHNOLOGIES INC (NYSE:UBER) Presents a Strong Growth and Technical Setup Opportunitychartmill.com

Via Chartmill · January 21, 2026

Via Benzinga · January 21, 2026

Digital imaging and instrumentation provider Teledyne (NYSE:TDY) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 7.3% year on year to $1.61 billion. Its non-GAAP profit of $6.30 per share was 8% above analysts’ consensus estimates.

Via StockStory · January 21, 2026

Johnson & Johnson reported Q4 2025 revenue of $24.6 billion, beating expectations, while EPS came in at $2.46, just below forecasts.

Via Talk Markets · January 21, 2026

Via MarketBeat · January 21, 2026

Via Benzinga · January 21, 2026

Universal Health Services is expected to release its fiscal fourth-quarter earnings soon, and analysts project a double-digit earnings rise.

Via Barchart.com · January 21, 2026

CarGurus Inc (NASDAQ:CARG) Emerges as a Peter Lynch-Style GARP Investmentchartmill.com

Via Chartmill · January 21, 2026

Palo Alto Networks Inc (NASDAQ:PANW) Shows Strong Growth and Technical Setup for Potential Breakoutchartmill.com

Via Chartmill · January 21, 2026

Via Benzinga · January 21, 2026

Via Benzinga · January 21, 2026

Regional bank Dime Community Bancshares (NASDAQ:DCOM) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 24.4% year on year to $123.8 million. Its non-GAAP profit of $0.79 per share was 10.6% above analysts’ consensus estimates.

Via StockStory · January 21, 2026

Via Benzinga · January 21, 2026

Opening a new credit card in January could save you hundreds. Here's how to use your purchases to earn rewards or avoid interest in 2026.

Via The Motley Fool · January 21, 2026

Agilent Technologies will release its first-quarter earnings soon, and analysts anticipate a single-digit bottom-line growth.

Via Barchart.com · January 21, 2026

NRG Energy will release its fourth-quarter earnings soon, and analysts anticipate a double-digit profit dip.

Via Barchart.com · January 21, 2026

Via Benzinga · January 21, 2026

Private markets are booming as investors seek equity in buzzy startups like OpenAI, SpaceX and IPOs remain scarce.

Via Investor's Business Daily · January 21, 2026

Via Benzinga · January 21, 2026

A bear put spread is a vertical spread that aims to profit from a stock declining in price. It has a bearish directional bias as hinted in the name. Unlike the bear call spread, it suffers from time decay so traders need to be correct on the directio...

Via Barchart.com · January 21, 2026

The satellite radio operator has lost its shareholders a lot of money in recent years.

Via The Motley Fool · January 21, 2026

Japanese bonds rebounded strongly following a sharp selloff that had reverberated across global debt markets

Via Talk Markets · January 21, 2026

Regional banking company BankUnited (NYSE:BKU) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 7.8% year on year to $288.2 million. Its non-GAAP profit of $0.94 per share was 5.5% above analysts’ consensus estimates.

Via StockStory · January 21, 2026

Brand Engagement Network announced the finalization of a strategic partnership with Valeo Technologies to establish an exclusive AI licensing framework for government and commercial markets across Africa.

Via Stocktwits · January 21, 2026

Verisk Analytics will release its fourth-quarter earnings soon, and analysts anticipate a low single-digit profit dip.

Via Barchart.com · January 21, 2026

TJX Companies will release its fourth-quarter earnings soon, and analysts anticipate a double-digit bottom-line growth.

Via Barchart.com · January 21, 2026

Financial services company Truist Financial (NYSE:TFC) fell short of the markets revenue expectations in Q4 CY2025 as sales rose 2.7% year on year to $5.25 billion. Its GAAP profit of $1 per share was 8.4% below analysts’ consensus estimates.

Via StockStory · January 21, 2026

One of these suggested stocks features a dividend yield topping 10%.

Via The Motley Fool · January 21, 2026

Apart from the outlook and subscriber numbers, analysts also pointed to Netflix’s revenue coming in at higher costs, while the company is also facing margin pressures.

Via Stocktwits · January 21, 2026

The latest rise in UK inflation – from 3.2% to 3.4% in December – shouldn't last.

Via Talk Markets · January 21, 2026

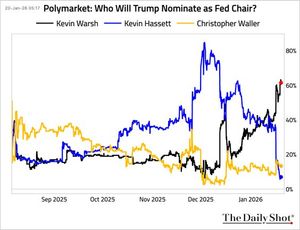

It appears that President Trump wants Kevin Hassett to remain in his role at the White House.

Via Talk Markets · January 21, 2026

Synopsys will release its first-quarter earnings soon, and analysts anticipate a single-digit bottom-line growth.

Via Barchart.com · January 21, 2026

Rockwell Automation deepens collaboration with Lucid Group to support first vehicle manufacturing site in Saudi Arabia.

Via Benzinga · January 21, 2026

Intel was first to market with backside power delivery.

Via The Motley Fool · January 21, 2026

Via Benzinga · January 21, 2026