Biglari Holdings Inc. Class B Common Stock (BH)

470.65

+23.85 (5.34%)

NYSE · Last Trade: Jan 21st, 2:57 PM EST

Detailed Quote

| Previous Close | 446.80 |

|---|---|

| Open | 448.50 |

| Bid | 466.50 |

| Ask | 473.64 |

| Day's Range | 440.85 - 471.65 |

| 52 Week Range | 195.05 - 465.73 |

| Volume | 76,496 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 63,399 |

Chart

About Biglari Holdings Inc. Class B Common Stock (BH)

Biglari Holdings Inc. is a diversified holding company primarily involved in the restaurant and insurance sectors. The company operates and manages a variety of well-known restaurant chains, focusing on creating value through strategic acquisitions and efficient management practices. In addition to its restaurant operations, Biglari Holdings also engages in investment activities, including the ownership of different insurance companies, thus broadening its financial portfolio. The firm is known for its unique approach to business, emphasizing long-term growth and value creation for its shareholders. Read More

News & Press Releases

Fast food chain Steak ‘n Shake, a wholly owned subsidiary of Biglari Holdings (NYSE:BH), announced Tuesday it will give a Bitcoin <

Via Benzinga · January 21, 2026

The CEO of this diversified restaurant franchise holding company is buying shares like hot cakes, all while the stock has been sizzling.

Via The Motley Fool · January 13, 2026

An all-in-one Supercharging station, dine-in restaurant, and drive-in movie theater years in the making from Tesla Inc (NASDAQ:TSLA<

Via Benzinga · July 22, 2025

Biglari Holdings just reported results for the second quarter of 2024.

Via InvestorPlace · August 12, 2024

Biglari Holdings just reported results for the fourth quarter of 2023.

Via InvestorPlace · June 26, 2024

Jack in the Box adopted a ‘poison pill’ to avoid a hostile takeover after activist investor Sardar Biglari’s hedge fund accumulated 9.9% of the company’s stock.

Via Stocktwits · July 2, 2025

U.S. Health Secretary Robert F. Kennedy Jr. has championed "medical freedom" while simultaneously limiting access to COVID-19 vaccines and restricting food stamp purchases, creating what public health experts call a dichotomy in his approach to healthcare policy.

Via Benzinga · June 6, 2025

Restaurant company Steak ‘n Shake is a sponsor of the Bitcoin 2025 Conference and used the event to share an update on its recent push into Bitcoin (CRYPTO: BTC) as a payment option, as it also embraced the crypto community via

Via Benzinga · May 28, 2025

Robert F. Kennedy Jr. faces mounting pressure from Republican lawmakers and farming communities as his highly anticipated "Make America Healthy Again" report approaches Thursday's release.

Via Benzinga · May 22, 2025

Biglari Holdings just reported results for the first quarter of 2024.

Via InvestorPlace · May 10, 2024

Via Benzinga · May 9, 2024

Restaurant company Steak ‘n Shake is entering the world of cryptocurrency with plans to accept Bitcoin (CRYPTO: BTC) at all locations later this month.

Via Benzinga · May 9, 2025

Restaurant diners appear ready to try the beef tallow cooking method supported by Robert F. Kennedy Jr. based on the results of a new poll.

Via Benzinga · March 20, 2025

Robert F. Kennedy Jr. wants to incentivize restaurants to switch from seed oils to beef tallow. He visited a restaurant making the switch.

Via Benzinga · March 12, 2025

Steak 'n Shake restaurants in Ohio, Colorado, Florida, Texas and Oklahoma are cooking fries with beef tallow instead of oil.

Via Benzinga · February 28, 2025

Via Benzinga · November 26, 2024

With the stock being so beat up heading into tomorrow morning’s report, anything decent could spur a relief rally.

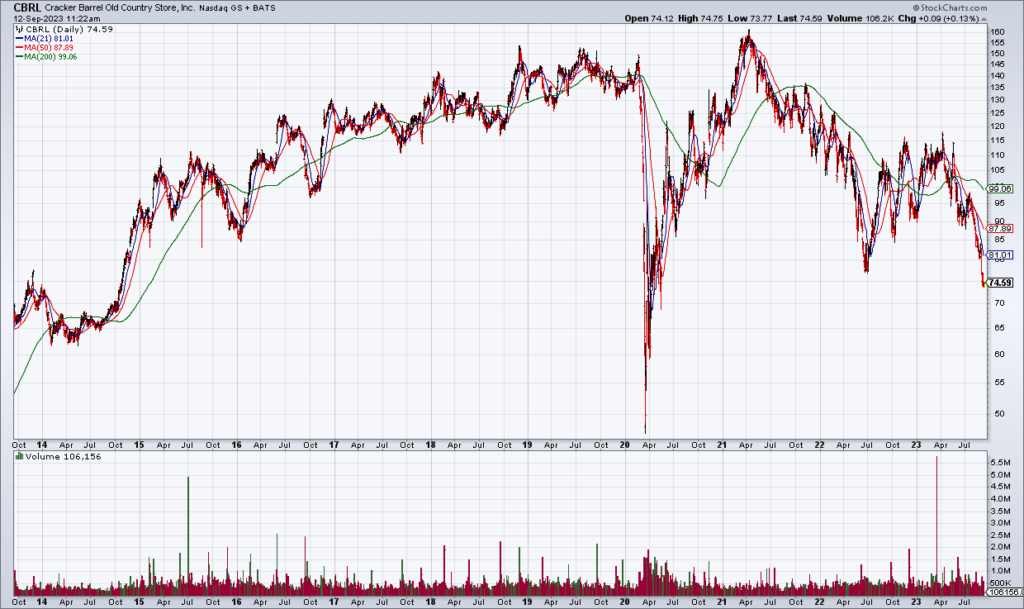

Via Talk Markets · September 12, 2023

Cracker Barrel has hurdles to cross, but is turning a corner in 2024, ready to focus on its turnaround efforts in F2025.

Via MarketBeat · September 20, 2024

When it comes to these three popular meme stocks, the best and the worst aren’t so obvious as one might think.

Via InvestorPlace · May 22, 2024

The market mood may continue to be lackluster, with index futures indicating a mixed opening on Wednesday.

Via Benzinga · January 10, 2024

AM Best has revised the outlooks to positive from stable and affirmed the Financial Strength Rating of B++ (Good) and the Long-Term Issuer Credit Rating of “bbb+” (Good) of Southern Pioneer Property and Casualty Insurance Company (Southern Pioneer) (Jonesboro, AR).

By AM Best · Via Business Wire · October 27, 2023