MP Materials Corp. Common Stock (MP)

61.40

+0.00 (0.00%)

NYSE · Last Trade: Mar 4th, 6:29 AM EST

Detailed Quote

| Previous Close | 61.40 |

|---|---|

| Open | - |

| Bid | 61.71 |

| Ask | 62.00 |

| Day's Range | N/A - N/A |

| 52 Week Range | 18.64 - 100.25 |

| Volume | 17,389 |

| Market Cap | 10.91B |

| PE Ratio (TTM) | -122.80 |

| EPS (TTM) | -0.5 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 6,301,329 |

Chart

About MP Materials Corp. Common Stock (MP)

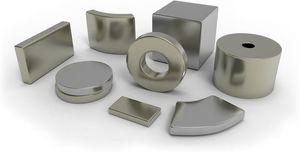

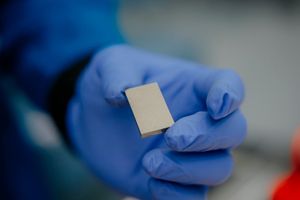

MP Materials Corp is a leading firm in the rare earth materials industry, primarily focused on the production and processing of rare earth elements essential for various advanced technologies. The company operates a significant mining and manufacturing complex, where it extracts and refines these critical materials, which are vital for applications in electric vehicles, renewable energy systems, defense technologies, and many electronics. By harnessing these resources domestically, MP Materials aims to support the growing demand for rare earths while promoting a more sustainable supply chain in the United States. Read More

News & Press Releases

EQNX::TICKER_START (NASDAQ:ALOY)(NYSE:VALE),(NYSE:UUUU),(NYSE:MP),(NASDAQ:CRML),(NASDAQ:USAR) EQNX::TICKER_END

Via FinancialNewsMedia · March 3, 2026

NUUK, GREENLAND — In a dramatic pivot that has sent shockwaves of relief through global financial markets, the geopolitical standoff over Greenland has reached a definitive resolution. Following months of aggressive rhetoric concerning territorial acquisition and the looming threat of punitive "Security Tariffs," the United States and its European allies have

Via MarketMinute · February 27, 2026

This company is helping resolve a key strategic rare earth supply chain problem for the U.S.

Via The Motley Fool · February 27, 2026

MP MATERIALS CORP (NYSE:MP) Reports First GAAP Profit Amid Strategic Pivot, Fueled by U.S. Government Agreementchartmill.com

Via Chartmill · February 26, 2026

Data from Stocktwits showed that retail sentiment on SPY has moved to ‘bullish’, while it remained ‘bearish’ on QQQ.

Via Stocktwits · February 27, 2026

MP Materials Corp (NYSE:MP) reports fourth-quarter financial results Thursday after the close. Here are the key highlights from the quarter.

Via Benzinga · February 26, 2026

MP Materials Corp. (NYSE: MP) (“MP Materials” or the “Company”), today announced its financial results for the fourth quarter and full year ended December 31, 2025.

By MP Materials · Via Business Wire · February 26, 2026

MP Materials Corp. (NYSE: MP) today announced it has selected a 120‑acre site in Northlake, Texas, to develop “10X,” the company’s planned large-scale rare earth magnet manufacturing campus. Located less than 10 miles from MP’s existing Independence facility in Fort Worth, the new campus will cement North Texas as the center of gravity for the United States’ rare earth magnet supply chain.

By MP Materials · Via Business Wire · February 26, 2026

EQNX::TICKER_START (NASDAQ:ALOY),(NYSE:MP),(NYSE:SQM),(NYSE:AMPX),(NASDAQ:CRML),(NYSE:NMG) EQNX::TICKER_END

Via FinancialNewsMedia · February 26, 2026

WASHINGTON, D.C. — Global financial markets are breathing a collective sigh of relief this February 25, 2026, as the dust settles on one of the most volatile periods in recent geopolitical history. Following a tense standoff that saw the White House threaten sweeping "Security Tariffs" on European allies over the

Via MarketMinute · February 25, 2026

In a move that signals a radical shift in American industrial policy, the Trump administration has officially finalized a $1.6 billion investment package in USA Rare Earth (NASDAQ: USAR), including a direct 10% equity stake for the federal government. The announcement, made through the Department of Commerce on January

Via MarketMinute · February 25, 2026

SANTIAGO, Chile / WASHINGTON D.C. — February 19, 2026 — As the global race for mineral sovereignty reaches a fever pitch, the United States has intensified its multi-billion-dollar strategy to dismantle China’s long-standing monopoly over the rare earth supply chain. Central to this effort is a new wave of "friend-shoring" initiatives

Via MarketMinute · February 19, 2026

The U.S. is working on a critical minerals price-floor system to strengthen supply chains for resources considered vital to national security, according to a Bloomberg report.

Via Stocktwits · February 18, 2026

MP Materials and USA Rare Earth are solving the same problem. Which one will make investors rich over the long term?

Via The Motley Fool · February 14, 2026

President Trump's Project Vault has rare earth stocks surging. Here are 7 critical questions about which mining stocks could benefit from the $12B initiative.

Via InvestorPlace · February 13, 2026

The domestic critical minerals market has been set ablaze this February as shares of USA Rare Earth (NASDAQ: USAR) experienced a historic rally, surging more than 60% year-to-date. This explosive movement stems from a powerful confluence of massive federal intervention and high-level financial speculation. At the heart of the frenzy

Via MarketMinute · February 13, 2026

The U.S. government continues to support the domestic rare-earth industry, and that's good news for MP Materials.

Via The Motley Fool · February 13, 2026

NATO's action across the pond has investors uneasy about this rare earth stock today.

Via The Motley Fool · February 12, 2026

Securing a domestic supply of critical rare-earth materials and magnets is a priority for the current administration, which means USA Rare Earth is in favor.

Via The Motley Fool · February 12, 2026

As of February 11, 2026, the global economy is navigating the aftershocks of a geopolitical standoff that nearly dismantled the post-war trade order. The "Greenland Tariff Escalation," a high-stakes diplomatic confrontation sparked by the United States’ aggressive pursuit of the world’s largest island, has shifted from an imminent trade

Via MarketMinute · February 11, 2026

MP Materials surged 224% in 2025. Can the rare-earth miner beat the market in 2026?

Via The Motley Fool · February 11, 2026

Is this deal as good as it seems for USA Rare Earth?

Via The Motley Fool · February 10, 2026

Via MarketBeat · February 9, 2026

These mining stocks could help you hit pay dirt.

Via The Motley Fool · February 9, 2026

The periodic table never looked so lucrative. These three mining stocks want to capture the upside.

Via The Motley Fool · February 7, 2026